Referendum

- Referendum

- The Need

- The Plan

- The Cost

- Election Information

- FAQs

Howard Lake-Waverly-Winsted Public Schools

2023 Referendum

Vote November 7th

The HLWW School Board will be asking voters to approve an Operating Levy of $600 per pupil, tied to the rate of inflation for the next 10 years.

We have a lot to be proud of at Howard Lake-Waverly-Winsted Public Schools. Our kids are not just learning – they’re thriving! Unfortunately, inflation, and state funding increases that don’t keep pace with inflation, has created budget challenges that we’ve been talking about for years.

Please use this website as a resource for factual information about the 2023 Operating Levy Referendum.

If you have any questions, please review the Frequently Asked Questions section of this website, or contact Superintendent Nate Walbruch at nwalbruch@hlww.k12.mn.us.

For several reasons, Howard Lake-Waverly-Winsted Public Schools has significant budget issues. We made $550,000 in budget cuts this year, but the district is expecting a $345,000 deficit budget next year, with larger deficits in future years if nothing is done.

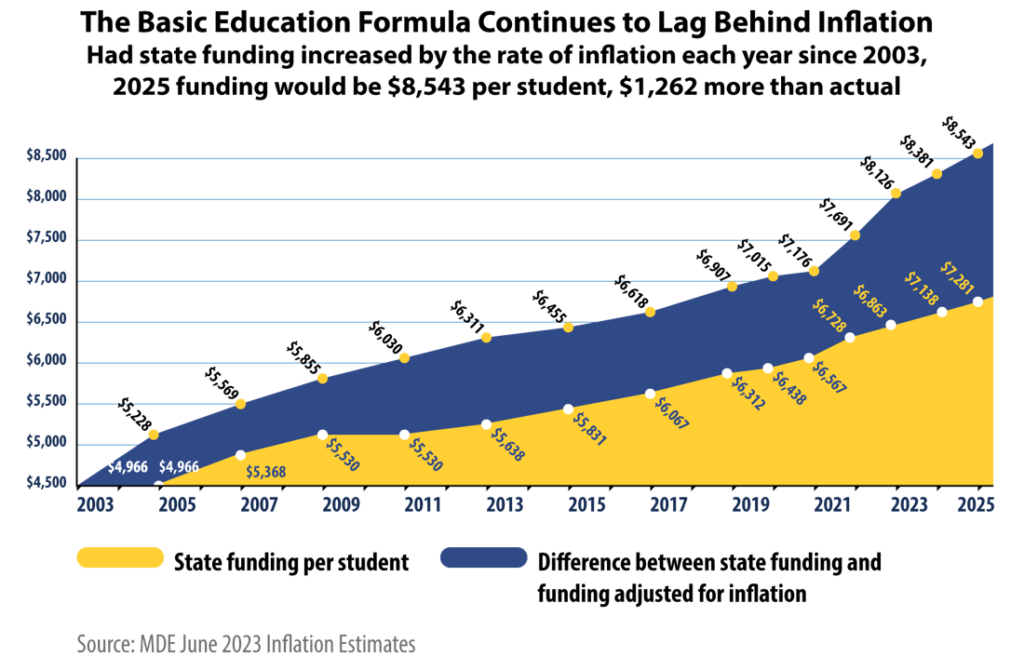

State revenue increases do not keep pace with inflation

HLWW is not the only school district with financial challenges. Our challenges stem from:

- State education funding increases have not kept pace with inflation

- Previous operating levy expiration

- Costs are increasing

- End of Covid/ESSER funds

Had funding from the state increased at the rate of inflation, HLWW Schools would receive $1.6 million more next school year alone. Meanwhile, cost increases, such as in critical special education programs, for example, are expected to cost the district $377,000 more than it receives this year from the state and federal governments.

We’ve proactively managed our finances

As you know, we have been seeking assistance from the community with referendum requests over the last several years, each of which were rejected. Without increased revenue we were forced to:

- Consistently adjust our budget – we made $550,000 in budget reductions this year

- Many adjustments were made by not refilling positions after retirements or resignations

Even though cuts were made, the district is expecting a $345,000 deficit budget in school year 2024-2025 and will use fund balance (the district’s savings account) to address the issue. The fund balance will be gone by 2026 if nothing is done. Below is a chart showing the reductions the district made for school year 23-24.

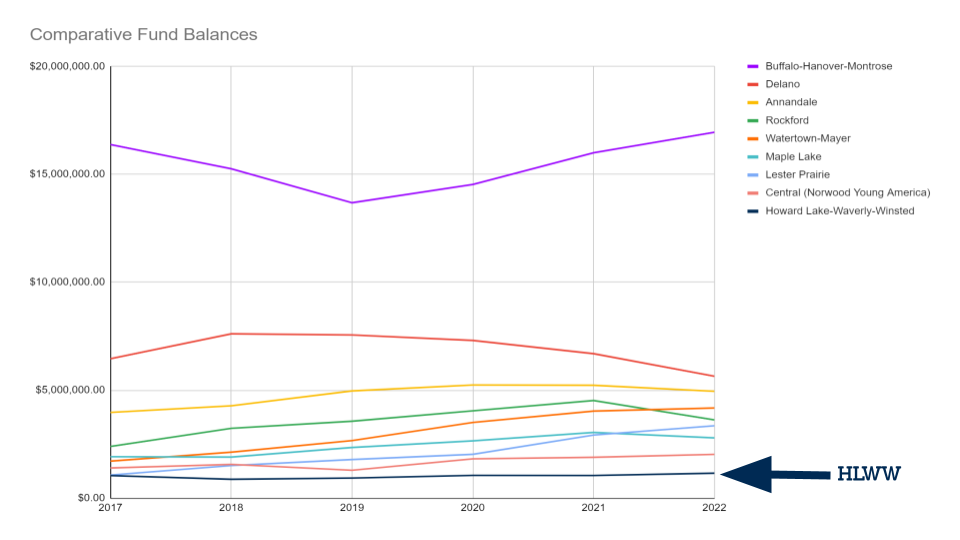

Fund Balance

The current reality of limited state funding and our proactive approach to our finances has left our district with a limited fund balance (savings account). The fund balance is used to help make up for late or reduced revenue, increasing expenses, and unanticipated challenges. At one point, having a limited fund balance was appropriate. Now it is a liability as we are needing to respond to delayed revenue payments to the district, facility repairs and other unforeseen expenses. We are at the point where we will need to borrow money and pay interest to make payroll and to keep the school lights on. The chart below shows HLWW’s fund balance compared to neighboring school districts:

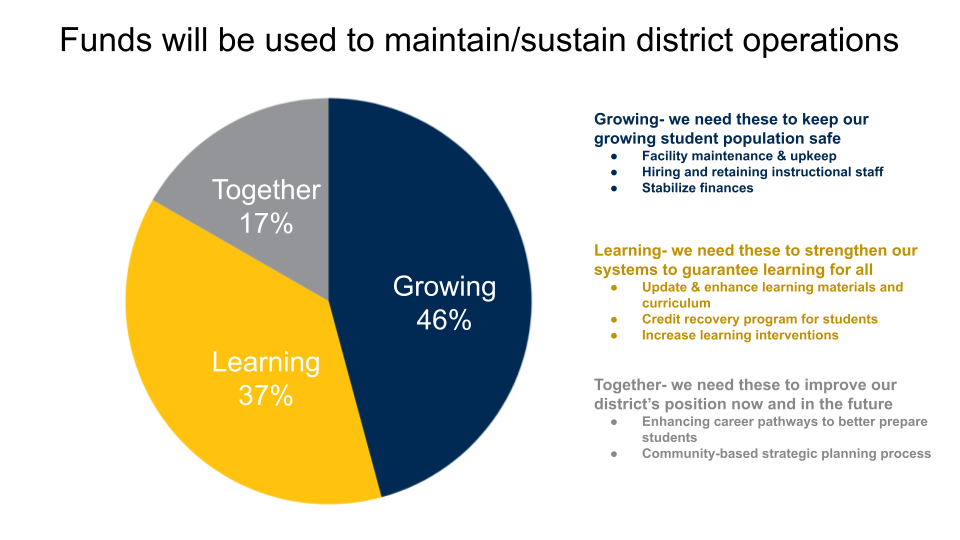

The HLWW School Board will be asking voters to approve an Operating Levy of $600 per pupil, tied to the rate of inflation for the next 10 years.

- Allocate resources to properly maintain facilities and equipment

- Attract and retain quality staff

- Attract and retain students/families

- Stabilize finances by more appropriately funding the district’s fund balance to

support unanticipated expenses throughout the school year

- Keep class sizes low

- Update and enhance classroom resources and curriculum used for learning

- Community-based strategic planning process

- Long-term opportunities with new leadership, a new approach, and new possibilities

- Enhance career training pathways to better prepare students for post-graduation

If the operating levy is not approved, we will be forced to undertake further and more drastic budget cuts. Even with those cuts we do not believe we can make enough budget reductions to solve our financial challenges as the size and scope of our unfunded and underfunded mandated programs won’t allow us to balance our budget using cuts alone. The nature of the budget cuts we would make this year would result in larger class sizes, reduced aid for students needing additional support and elimination of some in-school and out of school opportunities for students

Example: Cutting ALL extracurricular activities would not solve the problem

As an example, our projected deficit in 2026-2027 is $611,000. If we eliminated all extracurricular activities, football, volleyball, Knowledge Bowl, FFA, plays, speech, and 25 other activities, plus support staff like coaches and the activities director, we would save $694,000. But it wouldn’t eliminate the deficit because we would no longer have the $203,000 in revenue generated through activities fees and ticket sales.

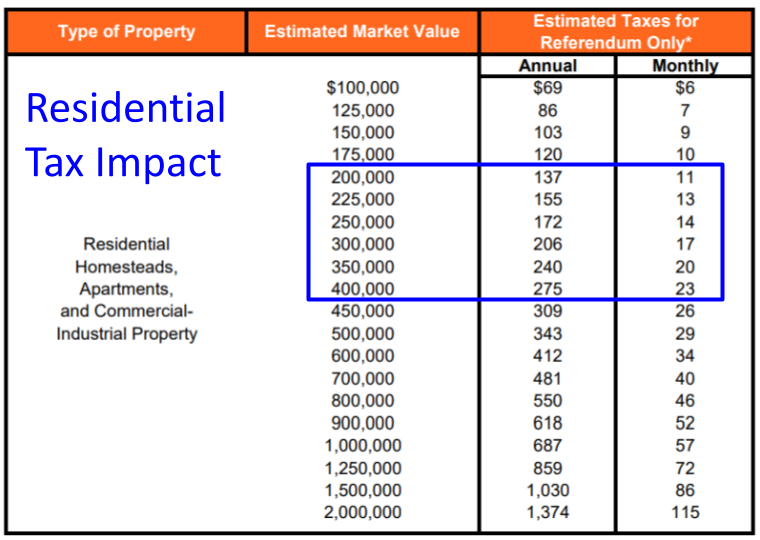

Did You Know? Farm families pay school operating levy taxes on just 1 acre of property that includes the house and garage.

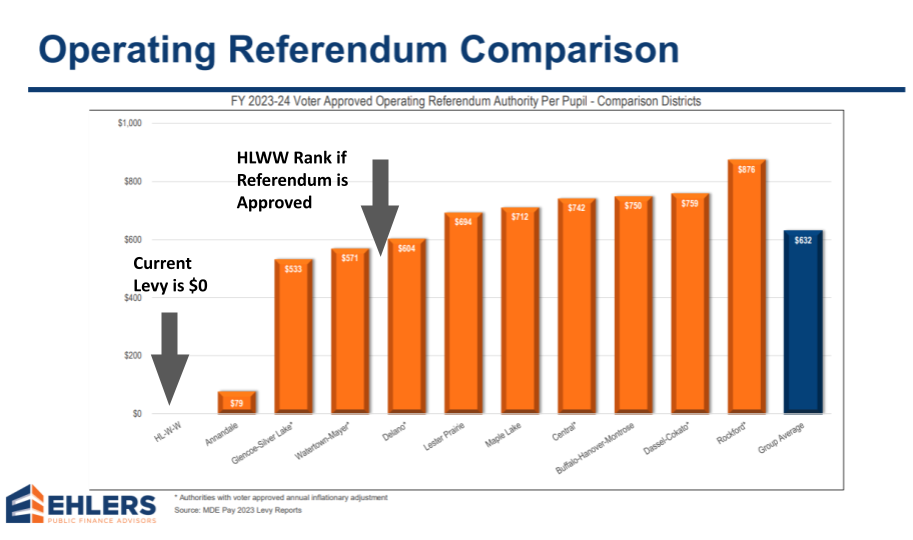

The HLWW School District has among the lowest of all taxing rates within neighboring schools. Even if the proposed referendum passes, the school tax bill would remain in the lower half of neighboring schools.

Voters can participate in the election through absentee ballot, voting early in-person and on election day, Tuesday, Nov. 7 from 7:00 a.m. to 8:00 p.m.

How Do I Vote Early In-Person?

Early in-person voting starts Sept. 22 through Nov. 6, in the HLWW District Office. During early in person voting before Nov. 7, you can complete your absentee ballot application and ballot at the same time in the HLWW District Office, 8700 County Road 6 SW, Howard Lake, Minnesota, from 8:00 am through 4:00 p.m. (CLOSED Fri., Oct. 20, 2023) You will seal your absentee ballot into an envelope to be processed and tabulated.

How Do I Vote on Election Day?

Election Day is November 7, 2023. There will be three (3) combined polling places for this special election that will be open from 7:00 a.m. to 8:00 p.m.

Combined Polling Place

Howard Lake City Hall

625 8th Ave

Howard Lake, MN 55349

This combined polling place serves all territory in Independent School District No. 2687 located in the City of Howard Lake; and Middleville, Victor, Albion and Stockholm Townships; all in Wright County, Minnesota.

Combined Polling Place

Waverly City Hall

502 Atlantic Ave.

Waverly, MN 55390

This combined polling place serves all territory in Independent School District No. 2687 located in City of Waverly; and Marysville and Woodland Townships; all in Wright County, Minnesota.

Combined Polling Place

Winsted City Hall

201 First Street North

Winsted, MN 55395

This combined polling place serves all territory in Independent School District No. 2687 located in the City of Winsted; and Winsted Township, in McLeod County, Minnesota; and Hollywood Township in Carver County, Minnesota.

How Do I Register to Vote?

You can register to vote online before November 7 through the Minnesota Secretary of State website to save time on Election Day. If you forget to register before Election Day, Minnesota allows same-day voter registration.

Who’s Eligible to Vote in the 2023 Referendum Special Election?

Generally speaking, anyone who is 18 years old by Election Day, is a U.S. citizen, has been a resident of Minnesota for at least 20 days, and resides within the Howard Lake-Waverly-Winsted School District 2687 attendance area are eligible to vote on the November 7 Election Day referendum.

How Do I Register to Vote on Election Day at the Polls?

Voters registering on Election Day will need proof of identity and residence, which may include:

- Minnesota Driver’s License, Learner’s Permit, or Identification card showing a current address (or yellow receipt for any of these).

- Valid, previous registration from the same precinct.

- “Notice of Ineffective or Late Registration” from the Public Service office.

- A registered voter from your precinct who personally knows you reside in the precinct and will vouch for your identity.

- A photo ID and a current utility bill showing your name and address in the precinct.

Students at Howard Lake-Waverly-Winsted Public Schools will benefit from the operating levy because it will provide the revenue to:

- Attract and retain quality staff

- Keep class sizes low

- Restore teaching positions that were recently cut

- Update and enhance classroom resources and curriculum used for learning

- Enhance career training pathways to better prepare students for post-graduation

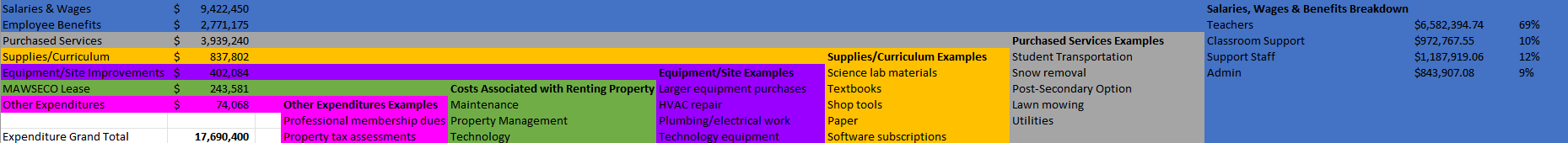

The school district will collect property taxes that equal $600 per pupil, or, based on this year’s enrollment, about $768,000 for each of the next 10 years. The amount would increase each year by the rate of inflation beginning with taxes payable in 2025.

If the operating levy is not approved, the district will be forced to undertake further and more drastic budget cuts. Even with those cuts we do not believe we can make enough budget reductions to solve our financial challenges as the size and scope of our unfunded and underfunded mandated programs won’t allow us to balance our budget using cuts alone. The nature of the budget cuts we would make this year would result in larger class sizes, reduced aid for students needing additional support and elimination of some in-school and out of school opportunities for students.

HLWW has the lowest operating levy taxes of our nine neighboring school districts. We have no operating levy while, on average, the other nine average $632 per pupil. Of those same districts, HLWW has the third lowest total taxes.

We simply do not have another option. We have two new board members and a new superintendent. Their assessment is this: while HLWW can and will make further budget adjustments and reductions in the future if we are not able to raise additional revenue, our unfunded and underfunded mandated programs won’t allow us to balance our budget using cuts alone. We recognize that voters have not approved the last several referendum proposals. The difference between those attempts and this one is that we’ve now made more than a half a million dollars in budget adjustments and the next rounds of reductions will be far more painful.

The State of Minnesota made important new investments in preK-12 schools during the recent legislative session, but those investments only helped HLWW and other school districts partly catch up from more than a decade of funding schools lower than the rate of inflation. Schools received an increase of 4% for 2023-24 and 2% for 2024-25 on the general education school funding formula and received some relief from the long-standing underfunding of mandated services for students with disabilities and for English Language Learners, which forced districts to spend general funds to make up the difference. These new revenues, while helpful, are not sufficient to fully fund these and other State and Federal mandates, to make up for decades where funding did not keep pace with inflation, or to make up for the recent period of high inflation, tight job markets, and other pandemic impacts. Those investments were welcome but won’t enable HLWW to help all students compete and thrive in a changing world.

HLWW used Federal COVID funding to preserve critical services for students during the pandemic and accelerate learning recovery afterward. All COVID funds have been allocated and, according to Federal law, must be expended by September, 2024. As a result, those funds are not a resource for continuing support for the mission of HLWW.

We believe we are. The district has worked hard to be a good steward of the public’s tax money. We have made difficult decisions to reduce our budget by more than $550,000 in this year. We have an Underlying Rating of “A” for Credit Program from Standard and Poors, which indicates the district’s strong credit-worthiness in spite of our necessity to consecutively use reserves to fund our operations, and our debt burden.

Yes, farm families pay school operating levies on 1 acre of property that includes the house and garage, not on all of your property. In addition, while the proposed levy is not eligible for tax credits, agricultural property has been paying less over the last several years for HLWW bonded debt. In 2017, the Minnesota Legislature approved a 40 percent tax credit for farm land school bond taxes. In 2019, the legislature approved higher tax credits to be phased in over time. In 2022, the credit was 60 percent; it’s 70 percent in 2023 and after.

The most rigorous research shows that, as scholars C. Kirabo Jacson and Claudia Persico put it, “there is a strong causal relationship between increased school spending and student achievement.” To read the scholar’s review of that research, please visit https://onlinelibrary.wiley.com/doi/epdf/10.1002/pam.22520.

According to the National Bureau of Economic Research, there is a definite correlation between school expenditures and home values in any given neighborhood. A report titled, “Using Market Valuation to Assess Public School Spending,” found that for every dollar spent on public schools in a community, home values increased $20. These findings indicate that additional school expenditures may benefit everyone in the community, whether or not those residents actually have children in the local public school system.

If you itemize deductions for federal income taxes, you may deduct all property taxes paid.