For several reasons, Howard Lake-Waverly-Winsted Public Schools has significant budget issues. We made $550,000 in budget cuts this year, but the district is expecting a $345,000 deficit budget next year, with larger deficits in future years if nothing is done.

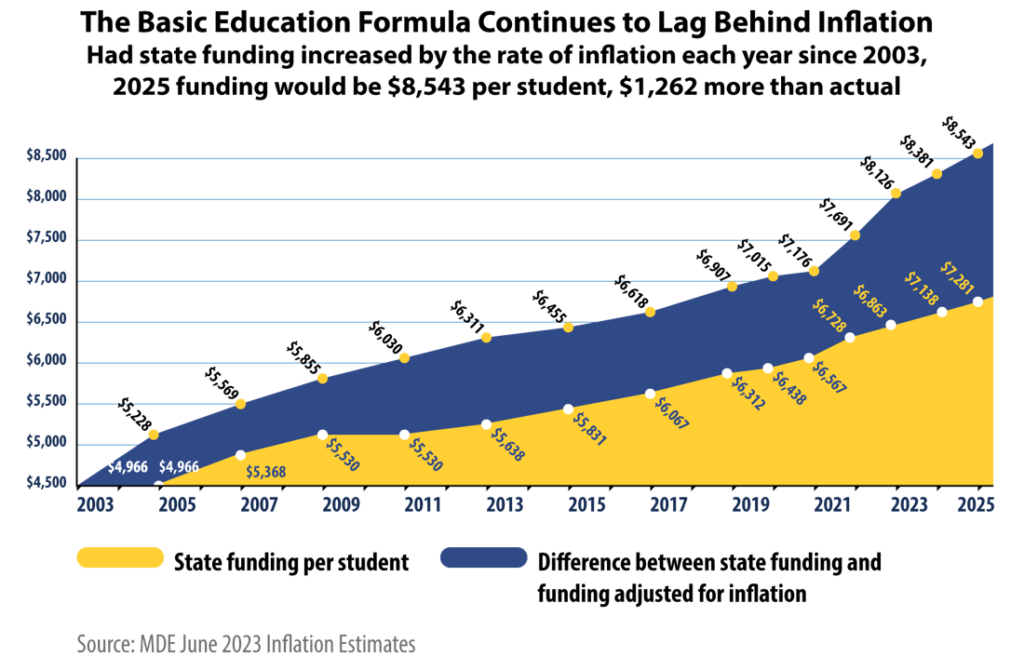

State revenue increases do not keep pace with inflation

HLWW is not the only school district with financial challenges. Our challenges stem from:

- State education funding increases have not kept pace with inflation

- Previous operating levy expiration

- Costs are increasing

- End of Covid/ESSER funds

Had funding from the state increased at the rate of inflation, HLWW Schools would receive $1.6 million more next school year alone. Meanwhile, cost increases, such as in critical special education programs, for example, are expected to cost the district $377,000 more than it receives this year from the state and federal governments.

We’ve proactively managed our finances

As you know, we have been seeking assistance from the community with referendum requests over the last several years, each of which were rejected. Without increased revenue we were forced to:

- Consistently adjust our budget – we made $550,000 in budget reductions this year

- Many adjustments were made by not refilling positions after retirements or resignations

Even though cuts were made, the district is expecting a $345,000 deficit budget in school year 2024-2025 and will use fund balance (the district’s savings account) to address the issue. The fund balance will be gone by 2026 if nothing is done. Below is a chart showing the reductions the district made for school year 23-24.

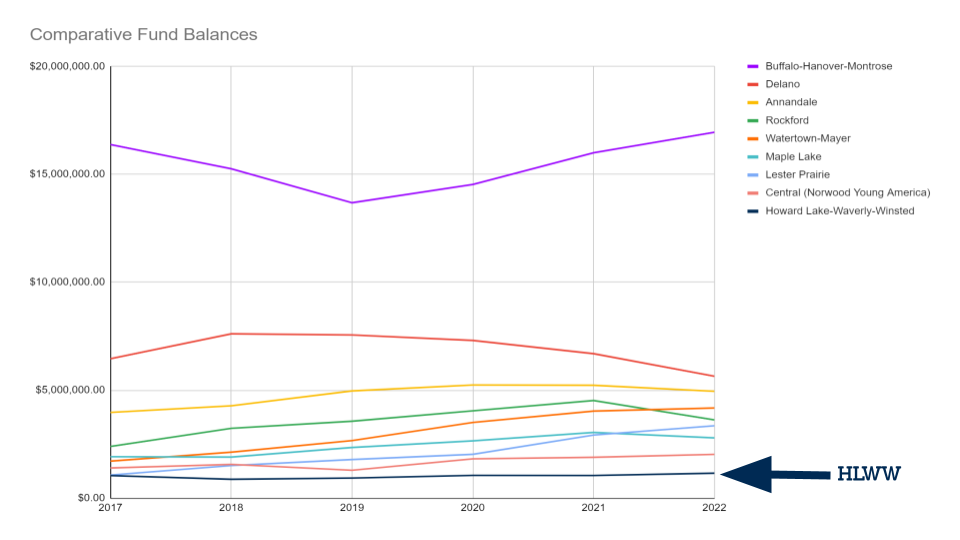

Fund Balance

The current reality of limited state funding and our proactive approach to our finances has left our district with a limited fund balance (savings account). The fund balance is used to help make up for late or reduced revenue, increasing expenses, and unanticipated challenges. At one point, having a limited fund balance was appropriate. Now it is a liability as we are needing to respond to delayed revenue payments to the district, facility repairs and other unforeseen expenses. We are at the point where we will need to borrow money and pay interest to make payroll and to keep the school lights on. The chart below shows HLWW’s fund balance compared to neighboring school districts: